Digital transformation is on everyone’s agenda. But the hardest part of any transformation is not deciding whether to embark on it; it’s understanding whether you’re seeing distinctive returns on your investment. Organizations often struggle to determine which actions drive the most impact and which investments yield the most enterprise value.

We examined which actions can increase the odds of transformation success, and we identified the actions that drive value: those that, when combined, can create outsized returns on tech investments and those that, when done in isolation, can destroy it. According to our analysis, the right combination of digital transformation actions can unlock as much as US$1.25 trillion in additional market capitalization across all Fortune 500 companies. But the wrong combinations can erode market value, putting more than US$1.5 trillion at risk. The takeaway: Getting digital transformation right takes more than just ambition and bold investments.

The power of being intentional in both words and actions

We applied data science to a decade of public shareholder filings, investor relations statements, and financial data. This covered more than three million pages of financial disclosures for 4,651 US and global firms listed on the New York Stock Exchange. The goal was to assess what impact, if any, digital transformation initiatives have on enterprise value, as determined by market capitalization.

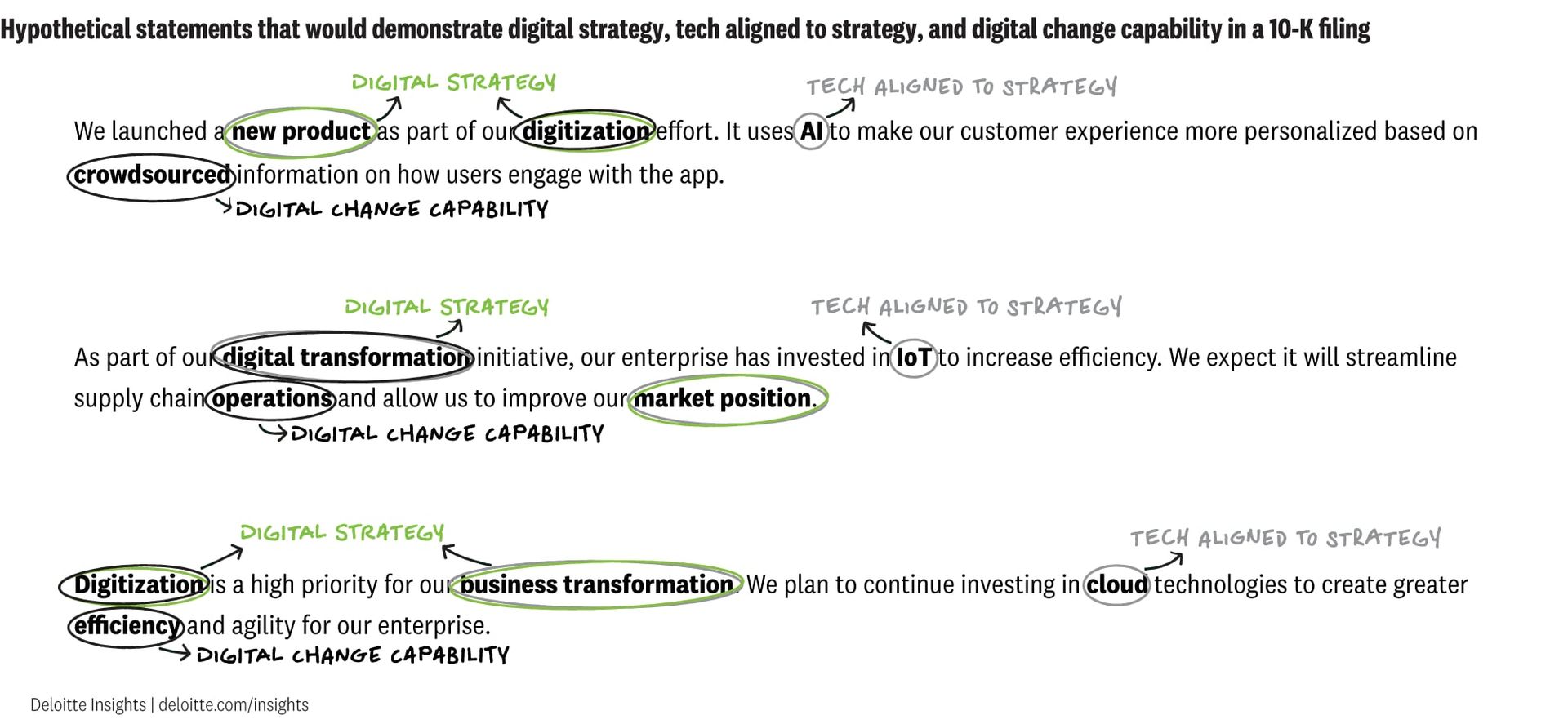

We analyzed these financial disclosures to ascertain how companies talked about their digital transformation actions—namely, how they spoke to (1) implementing a digital strategy; (2) their discrete, strategically aligned technology investments; and (3) their efforts to prepare their people and processes for digital transformation. Since these investor communications are governed by SEC regulations, they serve as a proxy for digital transformation intentions and the actions taken by the enterprise.

We applied natural language processing to scan the documents for keywords related to these actions. We then used a series of financial models to look for correlations between how the companies explained their digital transformation plans to investors and other stakeholders, and what valuations were assigned to the companies.

The findings

We found that the link between strategy and action is the determining factor in a company’s ability to derive the most value from its digital transformation. Research shows these actions can increase enterprise value if executed with intent, yet not all actions are created equal.

Clarifying the actions

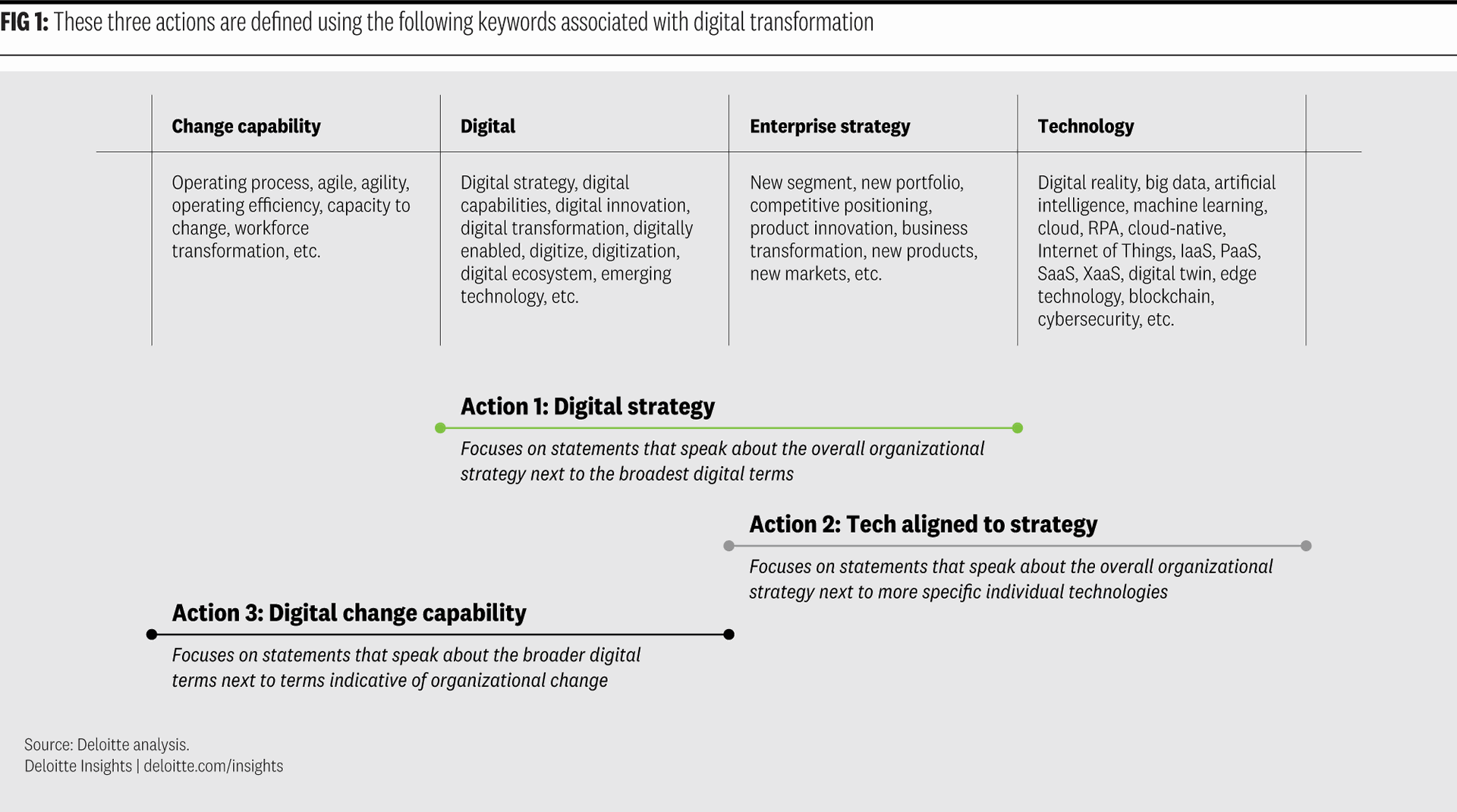

Our research began with a frequency analysis of terms commonly used to set strategies, enable technologies, and mobilize the enterprise for digital change. Once this data set was formed, we then pivoted to the relationships between select groups. These relationships were analyzed via clustering terms into various actions (figure 1).

These are the focal points most often discussed with our clients undergoing digital transformation and comprise a useful frame to understand how enterprises drive their efforts. In practical terms, they are defined as:

- Digital strategy: The strategic possibilities created by digital transformation. Examples of digital strategy terms include new digital capabilities, new markets, and new products—essentially, terms that describe efforts to enable a larger strategy, sometimes spanning multiple business units.

- Tech aligned to strategy: The technologies that come with digital transformation. When we say, “aligned to strategy,” we mean these technologies are being harnessed to achieve some discrete goal and bring the strategy to life.

- Digital change: The organization’s ability to adapt to and adopt new processes, resources, and ways of working. It refers to the more qualitative, human characteristics necessary for a transformation, encapsulating a multitude of talent domains.

How the individual actions drive value

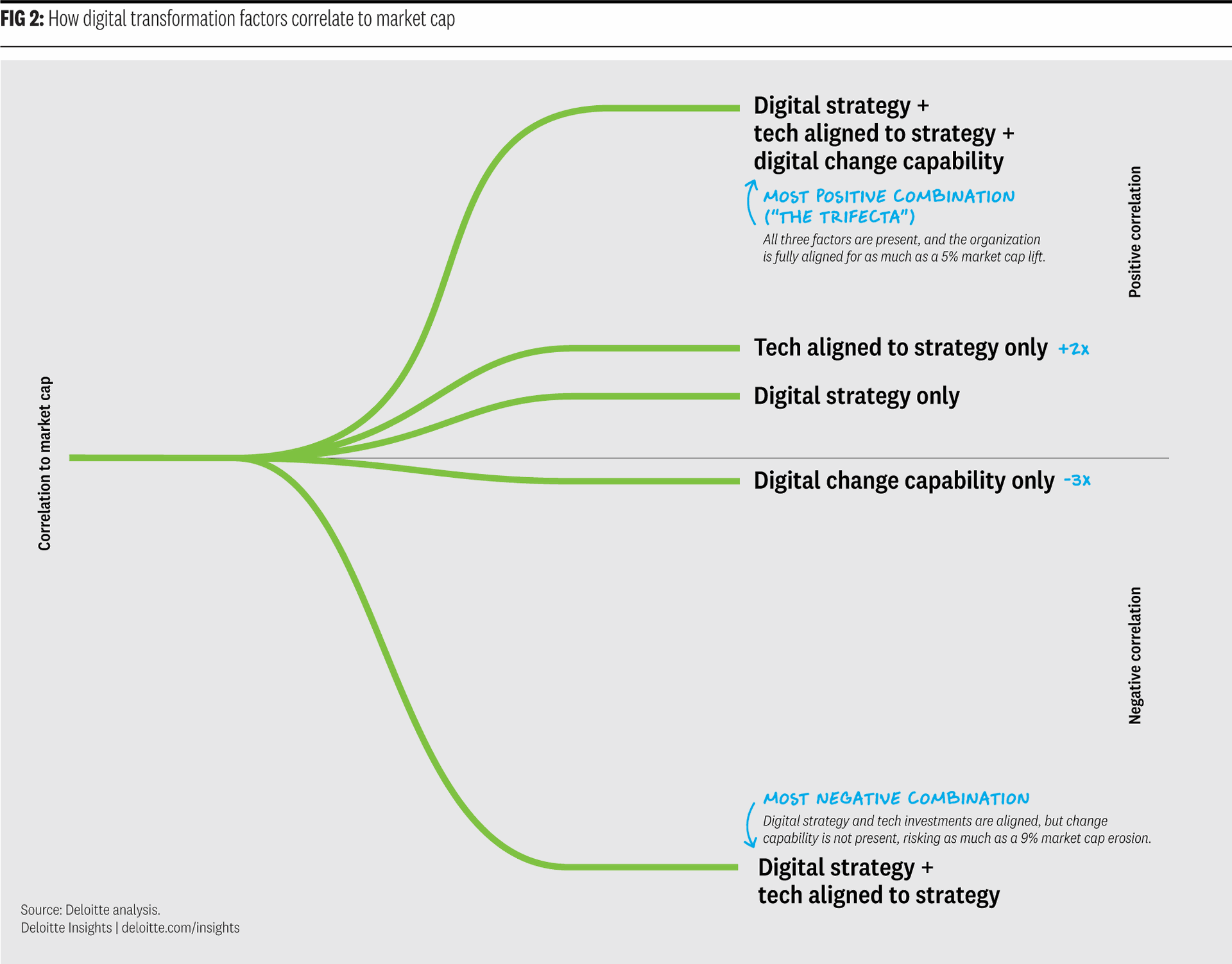

Each of these actions was correlated to market capitalization. We examined the impacts of each individually and in various combinations to understand which combinations could yield the greatest value—and which could yield the least. Several distinct patterns emerged:

Digital strategy

When a company articulated its digital strategy in its financial disclosures, we observed a significant positive impact on valuation. This is where many organizations start their digital transformation value journey, though only 44% have a high maturity related to this action. We hypothesize that the market understands the impact of “digital” on all companies regardless of industry and gives management credit for taking action to modernize the business in support of a broader strategy. Perhaps evidence of action, no matter how general, demonstrates an organization’s prioritization of digital goals.

Technology aligned to strategy

When we found evidence of technology aligned to strategy in companies’ financial disclosures, the valuation impact was two times higher than that of digital strategy. We believe the higher valuation is due to the specificity of technologies mentioned (figure 1). This likely gives stakeholders a more tangible sense of strategies employed, and a way to keep closer tabs on where the enterprise is placing its capital bets—which, for many, can be massive. Many of these technologies are also viewed as emerging or leading-edge and can reflect a forward-looking approach to improved performance.

Digital change

Despite the positive news around the previous two actions, our research uncovered a cautionary tale for digital change. When analyzing disclosures that articulated change programs in general terms or without reference to specific digital actions, we found that market capitalization eroded. When observed on its own, digital change was nearly three times less impactful than digital strategy and put existing market cap at risk of erosion.

We believe this occurs for two reasons. First, change for change’s sake, without purpose or any ties to a broader strategy, is insufficient. It lacks the specificity to mobilize stakeholders and rally them around shared interests. Second, many stakeholders understand that change can yield a high degree of uncertainty. Without a specific plan, stakeholders discount management’s ability to move the organization forward. Confidence is lost, momentum is impaired, and leadership could be viewed as chasing the latest management fad.

Consider Agile adoption over the years. Solving for a scaled Agile organization and achieving enterprise agility5 is certainly complex. It involves upskilling talent, building the right product teams, and instilling a new organizational mindset. But it goes well beyond that. To realize the value of Agile—the products enabled, the velocity expected, and the customer experience impacted—it all has to tie back to the enterprise strategy. If an Agile enterprise is built without these in mind, the enterprise is simply adopting a management trend and not taking full advantage of Agile as a solution. Our research suggests this is a path to value destruction.

Individual actions: The upshot

According to our analysis, if you can only do one thing, focus your efforts on technologies aligned to strategy because it drives superior market value. And the more specific you can be with stakeholders, the more you’re rewarded in the market. There’s power in being vocal about your actions with investors and other stakeholders. Think about investor relations as a possibly overlooked tool in your arsenal—a way to signal your confidence in the plans you have made and the actions you intend to take, and to demonstrate how strongly digital transformation figures into the enterprise’s plans.

How combined actions shape value

After we analyzed each of the actions individually, we looked for combinations that could unlock (or destroy) even more value. The results are compelling: Specific combinations of actions can yield up to a 5% increase in market capitalization, while other combinations can lead to significant value erosion risks of as much as 9%.

Transformers rejoice: Value is there if you execute with intention

The most positive combination is the digital trifecta: the presence of an articulated digital strategy, where specific technology investments are aligned and set, and the organization is mobilized and ready to manage the change. This equates to a value impact 1.2 times that of digital strategy applied individually, and nearly 3.5 times that of change capability on its own.

While it would be easy to dismiss the trifecta catalyst as conventional wisdom, the evidence shows otherwise. Only 34% of Fortune 500 companies we analyzed showed signs of being strategic about their technology investments in their financial disclosures. It’s possible that the remainder are making important investments, but have lost the plot line, are reluctant to disclose “too much” to competitors, or don’t know how best to convey the impact of those investments.

Transformers beware: Where you have the will, make sure you have the way

Our analysis revealed that change capability is the wild card: Its presence can make or break value for the enterprise. On its own, it’s a value eroder. As part of the trifecta, it’s a value catalyst. But when it’s entirely absent, we observed the worst outcome of all.

We found evidence that the combination of digital strategy and technology-aligned investments without change capability results in a significant erosion of enterprise value. The losses are 10 times greater than those seen with the other value destroyer: digital change on its own. In fact, it’s the most negative combination, posing a 9% value erosion risk that could cost Fortune 500 firms US$1.5 trillion in value.

But how can that be? How can the same actions that create an outsized return also destroy value? Digital transformations require buy-in at the onset, commitment to sustain, and organizational incentives to match. If you lack the capability to adopt and use those technologies or to bring the organization along on the change, you’ve wasted significant time, attention, and capital. Digital transformation, in this instance, becomes a distraction for management and top talent. Stakeholders are savvy enough to understand how hard transformational change can be and, as a result, significantly discount the value of the enterprise.

To combat the risks, how and when the organization directs its change capability can be a difference-maker. While it has a negative relationship to market cap on its own, when combined with one or two of the other actions, it’s an essential value catalyst. It turns the most negative scenario into the most positive one.

What impact do individual technologies have on market cap?

While our analysis suggests that discrete technology investments aligned to strategy can drive twice the competitive market capitalization than simply having a digital strategy, certain technologies are quicker to yield value than others.

Cloud was first out of the gate to spark digital transformation. It’s also a natural fit for our analysis, as it serves a forcing function from the strategy to the operating model changes that come in adoption. AI and cyber increase value, though over longer horizons. As adoption accelerates, we expect the same value impacts. Cloud is the leading indicator that foundational tech will drive returns if wielded intentionally.

Capitalizing on it all

Our research shows that the power of digital strategy, brought to life by specific technology investments, and underpinned by change capabilities, can meaningfully shift a company’s valuation (figure 2).

This is easier said than done, as unlocking each takes significant time, effort, and expertise. So for the companies that aren’t leading in this today, what can executives do to capitalize? Our research findings point to four actions:

- Be deliberate. When we analyzed approximately three million pages of financial disclosures, we didn’t look simply at the coexistence of digital strategy, technology aligned to strategy, and change capability. Rather, we examined both the coexistence and the proximity of those factors, and it’s the proximity of the factors that shows which companies are linking these concepts most deliberately. Proximity also made the difference in distinguishing companies that tend to outperform their peers in market valuation. Put simply, as you take deliberate action to advance your digital strategy, as you make the choice to invest in certain technologies, and as you evolve your organization’s change capability, make certain that you understand how those three factors are mutually enabling and reinforcing.13 Absent that alignment, your investments may not deliver the returns they could be producing.

- Communicate with purpose. Our analysis is rooted not only in what these statements say companies are doing, but also in how companies communicate with the market about their choices. Undoubtedly, the vast majority of organizations today are making some form of technology investment to improve how they operate and how they go to market, though nearly two-thirds are unable to link their technology investments to their strategy. Nor are they able to talk about the relationship between the two. Words without action can erode value. Actions without words also limit value potential. Take stock of where you’re investing, craft a thoughtful narrative, and communicate accordingly.

- Get close to the technology so you can get specific. Digital strategy is valuable, but technology aligned to strategy is twice as valuable. With the latter, companies that see added benefit are getting very specific about the technology investments they make, and they’re demonstrating how those technology investments further their enterprise strategy. It‘s not enough for executives to approve and fund technology; they also need to have a fundamental understanding of the technology. Be sure to invest the time—and invest in the relationships—necessary to get close to the technology: what it is, how it works, how it’s architected, and why it matters. And be certain that this understanding carries through into strategy discussions.

- Prepare, prepare, prepare. Any approach to digital transformation is suboptimal if it isn’t underpinned by change capabilities. And there’s only so much a company can do to fast-track. Change capability means bringing the right skill sets and culture, as well as agility. Unlocking all of this takes time, and the benefit goes to those who start earlier. Start now.

Succeeding with digital transformation requires assembling the right pieces in a multivariate puzzle. We examined multiple approaches here, but as we step back and think about the main insight from our analysis, it’s ultimately that intentionality matters.

Digital transformation is a continuous effort that extends well beyond one single technology, platform, or skill set. It’s the fabric for enterprise survival in the face of continuous disruption. Getting it right means crafting a strategy that places purposeful digital bets. Getting it right means allocating your capital to new technology that can power your strategic initiatives. Getting it right means mobilizing your organization and adopting a change mindset with no defined horizon (or a horizon that could go well beyond your tenure). And getting it right means explaining to stakeholders that your digital transformation actions are intentionally aimed at increasing the odds of your organization’s ongoing success.

Reference: Deloitte

Unleashing value from digital transformation: Paths and pitfalls